Beautiful Work Is Team Building Tax Deductible 2018

274e4 and 274n2A Meals and entertainment included in employee or non-employee compensation 100 IRC Secs.

Is team building tax deductible 2018. 6th Apr 2018. It is unlikely that the rest of the employees of the company will be offered a team building day. Once you are sure you qualify to deduct.

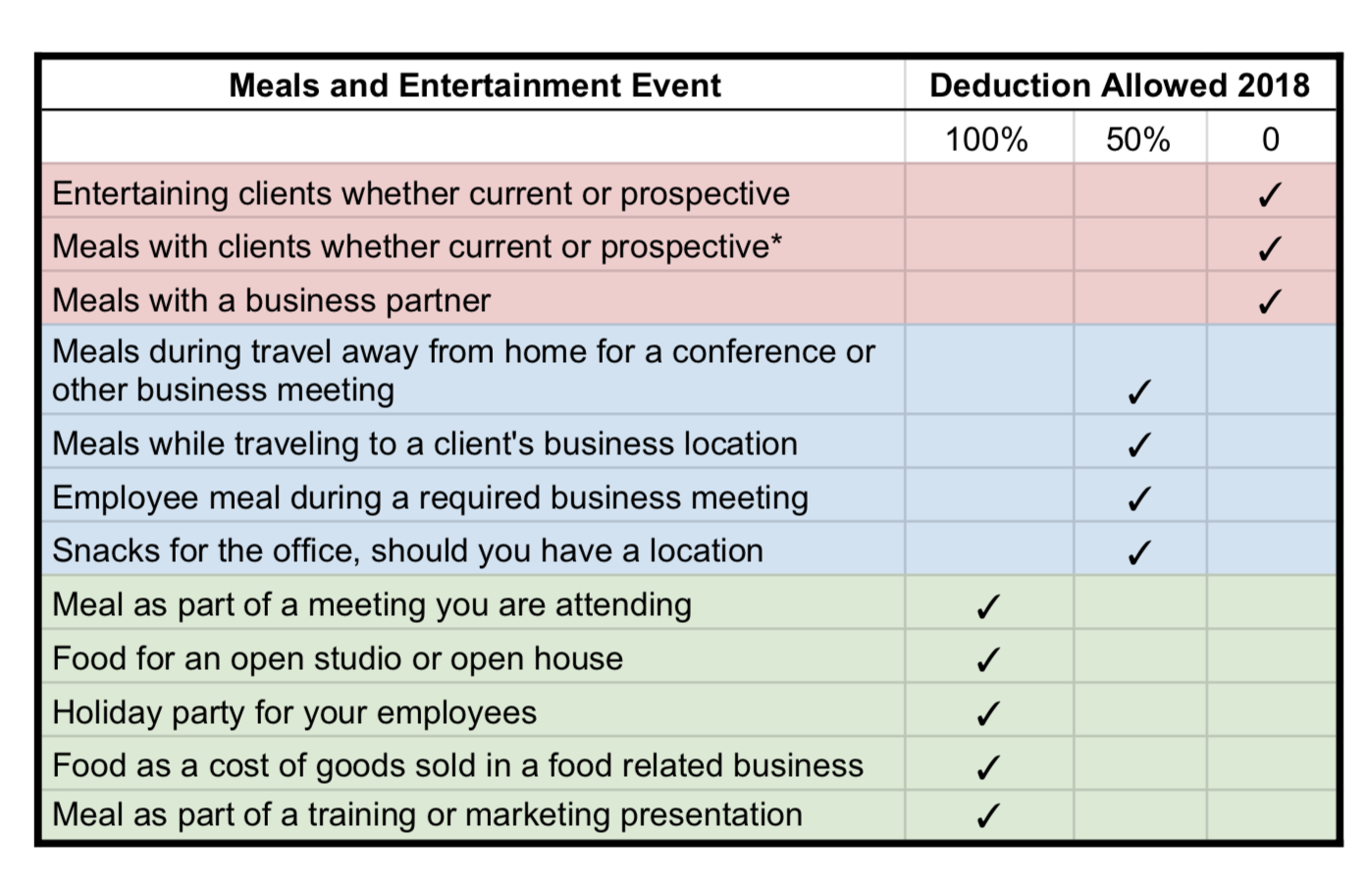

With the new tax reform enacted for 2018 we get a lot of questions from clients asking how the changes to the meals and entertainment expense deduction might affect them. Golf outings and even cruises are 100 tax-deductible IF the expenses are primarily for the benefit of employees---not for entertaining clients customers etc. Section 162 100.

In fact you might be able to write off the entire cost. Employee Meals Are Half As Tax-Deductible As They Used to Be. Here is a brief overview that hopefully helps you understand the implications and how you can carefully track these costs.

Deductions for business entertainment and meal expenses are among the many altered by the Tax. As a local commercial roofing company in Springfield MA we can honestly say tax season is not our favorite time of year either. This deduction is usually 50 and until now has been deductible with no questions.

Meal expenses incurred by an employee while at an out-of-town jobsite are 50 deductible to the company. Bruce is a business owner. If the expense doesnt help your business earn gross income its private and you cant claim it as a tax deduction even if you paid for it out of your business account.

Ford City 2018 - 2021 team building Through volunteer labour efficient management and tax-deductible donations of money and materials Habitat builds simple decent houses with the help of the homeowner partner families. New Tax Law Changes. Under the Tax Cuts and Jobs Act of 2017 meals with employees during which business is discussed are considered 50 percent deductible.