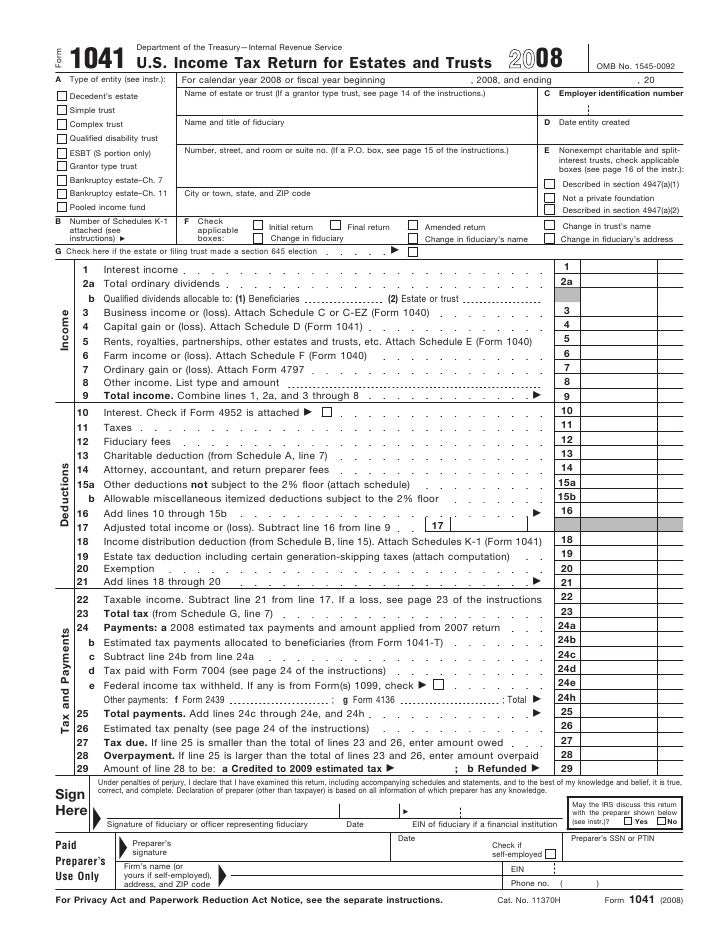

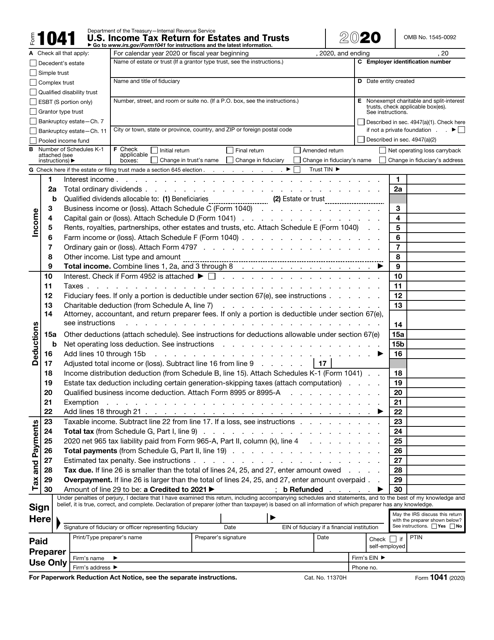

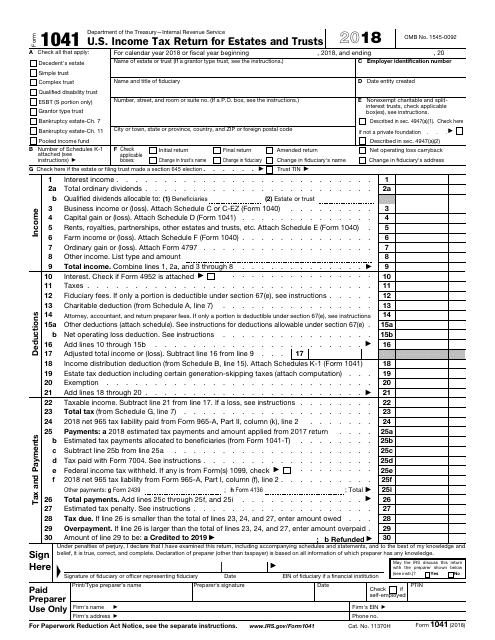

Amazing What Expenses Are Deductible On Form 1041

Line 15b of Form 1041 is the place for all other miscellaneous deductions.

What expenses are deductible on form 1041. State and local taxes paid. Executor and trustee fees. The IRS recently issued Notice 2018-61 which discusses deductions for trusts and estates filing Form 1041.

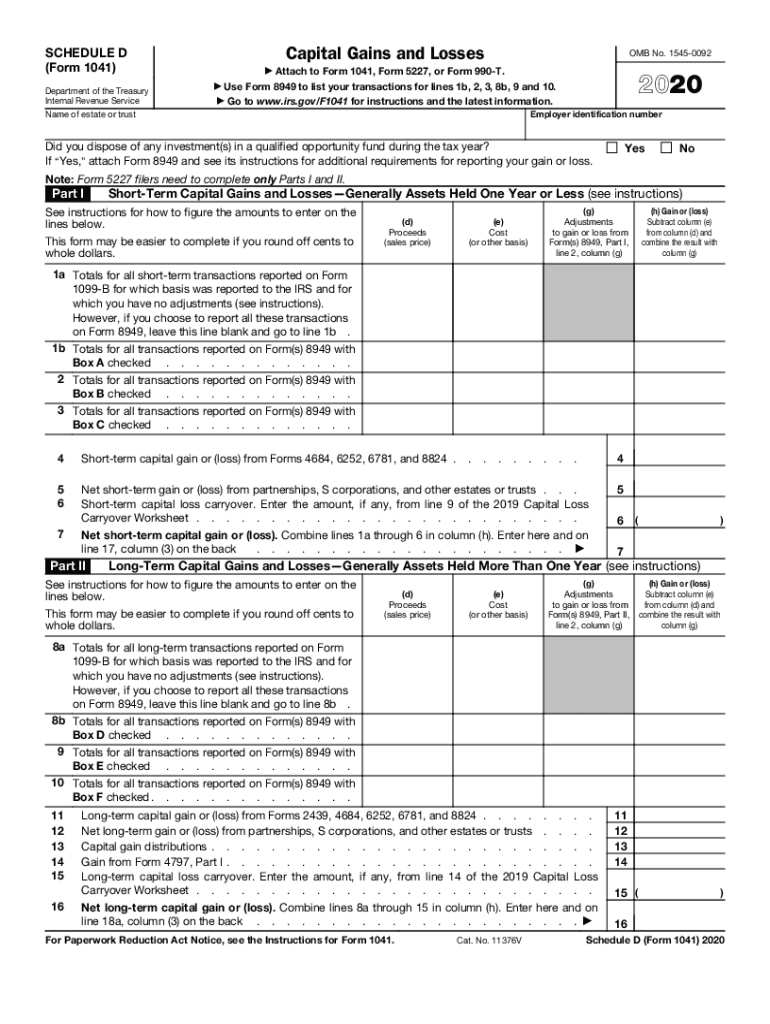

Box 11 code A was revised to read Excess deductionsSection 67e expenses and a new Box 11. Expenses that qualify for deductions include. The funeral expenses are a function of the deceaseds taxable estate and are included in the estate tax return Form 706.

Tax-exempt income received by an estate or trust requires an allocation of expenses between taxable income and tax-exempt income. To file IRS Form 1041 the executor needs to obtain a taxpayer identification number TIN for the estate. Funeral and final medical expenses are not deductible in Form 1041.

It appears that medical expenses paid by the Trust are not deductible but what about HOA fees and utilities etc. 278 7302018 the Internal Revenue Service has confirmed that administration expenses of trusts and estates that were fully deductible before the enactment of the 2017 tax act are still fully deductible for income tax purposes notwithstanding the elimination of miscellaneous. Rent utility bills and funeral of the decendent so that the beneficiaries.

However you cannot claim these expenses for both estate tax and income tax purposes. Excess deductions on termination. 278 7302018 the Internal Revenue Service has confirmed that administration expenses of trusts and estates that were fully deductible before the enactment of the 2017 tax act are still fully deductible for income tax purposes notwithstanding the elimination of miscellaneous itemized deductions under the 2017 tax act.

If all these conditions are satisfied then it will be presumed that the medical expenses were paid on the date when the expense was incurred. Ad Access IRS Tax Forms. Medical expenses of the decedent paid by the estate may be deductible on the decedents income tax return for the year incurred.