Glory What Expenses Are Deductible When Selling A Rental Property

Capital expenses on the other hand are only.

What expenses are deductible when selling a rental property. Jabari is the sole owner of a rental property on the Gold Coast. When I sell a rental property are any of the real estate closing fees tax deductible. If you are a partner in a partnership that has a capital gain the partnership will allocate part of that gain to you.

Rental property ownership has its benefits but selling can create a big tax hit. There is no jump to button. Capital expenses on the other hand are only 50.

If you are an investor selling a rental property you are likely looking for all of the income tax deductions you qualify for including what closing costs are tax deductible. If your income is above 100000 then the deductions go down by 50 cents for every dollar of income until it eventually phases out at the 150000 income level. January 27 2019.

Your eligible tax deductions change if youre selling an investment property since these properties attract capital gains tax CGT one of the costs of selling a property to factor in when youre planning your next move. Real estate by Income deduction So if you are making 1000000 or less you can write off up to 25000 a year in passive rental real estate losses. The deductions can cover the cost of maintaining the property while you wait to rent or sell it but those deductions will not apply if the unit is not on the market.

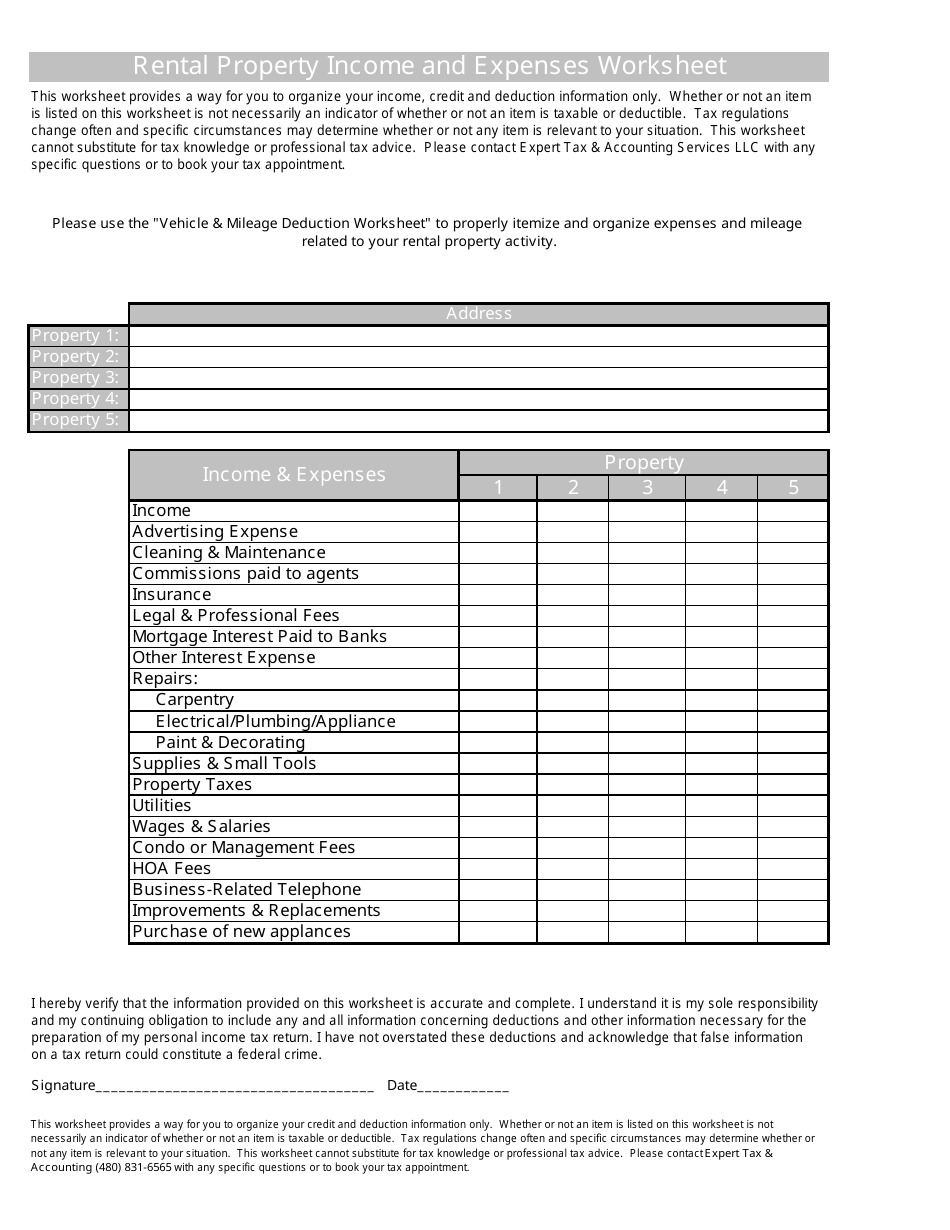

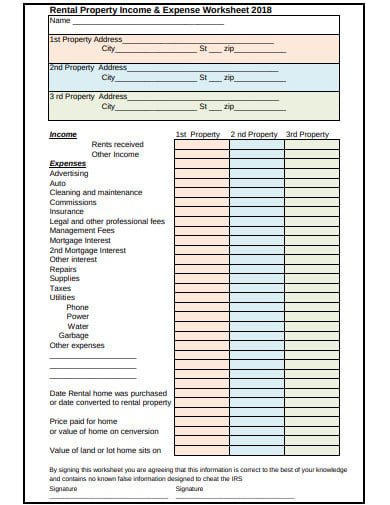

Taking full advantage of tax deductions and knowing what rental property closing costs are tax deductible will save you thousands of dollars over time especially when it comes to purchasing a rental property. Drafted By Professionals - Finish In Just 10 Minutes - Create Documents Effortlessly. Let us personally and professionally guide you through every step of your transaction.

If you sell property you held for rental purposes you can deduct the ordinary and necessary expenses for managing conserving or maintaining the property until it is sold. When someone owns a rental property they generally prefer current expenses as these are fully deductible in the year in which incurred. Condominium fees are tax deductible in some rental situations.